Chapter 19 - AI in Finance, Accounting, and Legal Compliance

- Zack Edwards

- Nov 27, 2025

- 31 min read

My Name is Luca Pacioli: Father of Accounting

I was born in 1447 in the quiet Tuscan town of Sansepolcro, a place of stone streets, quiet workshops, and the hum of merchants settling their accounts at dusk. I was not born into wealth, nor did I imagine a life that would one day shape how the world measures its fortunes. Yet numbers fascinated me even as a boy. I watched merchants tally sales with counters on wooden boards, marveling at how the movement of small stones could describe a day’s success or failure. It was in these early years that I discovered a truth that guided my life: without understanding numbers, one could not understand the world.

Education and the Venetian Connection

As a young man, I traveled to Venice, the beating heart of Mediterranean trade. Venice was an ocean of flourishing commerce, where goods from every known shore passed through the Rialto markets. I studied mathematics under masters who treated arithmetic as both an art and a discipline. But it was not only mathematics that shaped me—it was the Venetian merchants themselves. They lived by their ledgers. Every coin, every transaction, every promise made was logged with care. Their survival depended on accuracy. Their prosperity depended on organization. It was here that bookkeeping became not just a tool, but a philosophy.

The Birth of Double-Entry Bookkeeping

In Venice, I began to understand the elegance of the double-entry system. It was already in use among the merchants, but it lacked codification. I saw its beauty: every debit must have a credit, every movement of value mirrored by another. It reflected balance, order, accountability. It was like the symmetry of geometry or the harmony of music. I realized that if this system were recorded formally, others across Europe could adopt it, refine it, and use it to bring structure to their enterprise. I set myself the task of explaining it clearly, not as a merchant’s trick, but as a universal method.

Writing the Summa de Arithmetica

In 1494, I published my great work, the Summa de Arithmetica, Geometria, Proportioni et Proportionalità. Inside its pages, I devoted a section to the Venetian method of bookkeeping. I wrote of journals and ledgers, of inventories and balance accounts, of how to record cash, goods, and credit. I explained that without proper accounting, a business could not know its true state. Some have called that section humble, but it has endured longer than the rest. It became the cornerstone of modern accounting, not because it reinvented the system, but because it revealed its structure to the world.

On Internal Controls and the Art of Order

Merchants often asked me why I insisted on such order in their accounts. I told them that internal controls were not merely rules—they were protections. A ledger carefully kept reveals dishonesty as quickly as it reveals success. A system of checks and balances, where no one person controlled all the records, preserved trust. I saw internal controls as moral tools. In a world of temptation, careful accounting defended both the merchant and the clerk. It allowed trade to flourish on a foundation of integrity.

Audits and Accountability

In my travels, I served as an adviser to merchants, guilds, and noble households. I conducted audits where numbers told stories spoken nowhere else—stories of mismanaged funds, of forgotten debts, or of hidden profits. An audit was a form of truth-seeking. When done properly, it restored confidence. I came to believe that accountability, supported by transparent records, was a fundamental requirement of civilization. A society that maintained honest accounts maintained honest dealings.

Friendship with Leonardo da Vinci

Later in life, I lived and worked with Leonardo da Vinci. Our conversations wandered from the mathematics of perspective to the geometry of nature. He taught me the art of seeing, and I taught him the structure of numbers. Together, we studied proportion, harmony, and balance—principles shared equally by art, science, and accounting. Leonardo understood that my work was not merely administrative. It was an attempt to bring order to the chaos of human enterprise.

AI-Powered Bookkeeping & Automated Financial Records – Told by Luca Pacioli

In your era, the ledger has taken on a form I never witnessed, yet its purpose remains familiar. Where once hands dipped quills into ink, now your machines record each figure with unfailing precision. The essence of bookkeeping—clarity, order, and truth—has not altered. What has changed is the speed, the reach, and the remarkable intelligence of the tools you now possess. Artificial intelligence has become a silent partner, ensuring that no detail escapes notice and no account stands incomplete.

Clerks of Metal and Thought

If I could have shown a Venetian merchant a clerk who never tired, never lost a page, and never misread a number, he would have called it a miracle. Yet this is precisely what artificial intelligence accomplishes. When a transaction occurs, it is instantly gathered, examined, and stored in its proper place. The machine recognizes patterns as swiftly as a seasoned bookkeeper: it distinguishes between a sale and an expense, separates goods from services, and identifies how each movement of money affects the health of the enterprise.

Double Entry Reimagined

The principle I valued most—balance—finds new life in your automated systems. Every debit is mirrored by its credit without a moment’s hesitation. The software, guided by algorithms rather than intuition, preserves harmony in the accounts just as surely as any clerk trained in the Venetian tradition. Errors that once arose from fatigue or distraction are nearly eliminated, for the machine does not forget the rules of double entry. It lives by them.

A Ledger That Breathes in Real Time

In my day, a merchant might wait weeks to know whether his venture had turned profit or loss. Today, your ledgers speak instantly. Each purchase, payment, and deposit flows into the system the moment it occurs, revealing the enterprise’s condition with unprecedented immediacy. This swift visibility empowers decisions grounded in truth rather than guesswork. The merchant no longer navigates by memory but by constant and accurate illumination.

The Silent Watchman of Financial Integrity

Where humans once relied on caution and habit to detect irregularities, artificial intelligence now performs this diligence automatically. It identifies suspicious charges, flags improbable entries, and notices when a pattern departs from its expected course. This vigilance acts as a form of internal control woven directly into the fabric of the system. It guards against both error and deceit, preserving trust in every account it touches.

Restoring Time to the Merchant

The greatest gift of AI bookkeeping is not merely accuracy. It is time. The hours once spent sorting receipts, copying figures, and reconciling accounts are now freed for higher pursuits. A merchant may focus on improving goods, exploring new markets, or devising strategies for growth. The machine does not remove human responsibility but lightens the burdens that once weighed upon every enterprise.

A Partnership Between Reason and Calculation

Though these systems are powerful, they do not replace human understanding. They excel at recording, sorting, and guarding financial records, but they cannot judge ambition, prudence, or opportunity. Those decisions still belong to you. The true strength of AI bookkeeping lies in the partnership it forms: your insight paired with its precision. Together, the two create a clarity and confidence in financial management that surpass anything possible in my age.

My Name is Adam Smith: Founding Economist

I was born in 1723 in the seaside town of Kirkcaldy, Scotland, a place of merchants’ ships, narrow lanes, and families whose fortunes rose and fell with the tides. My father died before I could know him, and so I was raised by my mother, Margaret Douglas, whose gentle discipline shaped my character. From my earliest years, I was drawn not to the clamor of trade but to the quiet observation of it. I watched fishermen, weavers, and traders, noting how each depended on the other. Even then, I sensed that the wealth of a place came not from its gold, but from the ceaseless exchange of human effort.

Education and the Life of Inquiry

I entered the University of Glasgow at fourteen, where I first encountered the ideas that set my mind ablaze. Francis Hutcheson, my beloved mentor, taught that moral philosophy was not merely a study of right and wrong, but a study of human nature itself. This idea never left me. Later at Oxford, I learned less from lectures and more from the solitude forced upon me. I spent long hours reading classical authors, questioning why economies rose, why they fell, and why some societies flourished while others stagnated. I understood early that economics was not merely numbers—it was the study of people and their choices.

Professor and Observer of Human Behavior

Returning to Scotland, I became a professor at the University of Glasgow, teaching logic and moral philosophy. Yet it was outside the classroom, walking among markets and workshops, where my true education continued. I watched craftsmen make pins, noting how dividing the labor made the process faster, more efficient, and more profitable. I observed merchants setting prices based not on charity, but on their own interests. And I saw that despite their self-interest, their actions often benefited the whole community. These observations formed the seed that would later grow into my most famous ideas.

Travels in Europe and Conversations with Thinkers

I later traveled to France and Switzerland as a tutor, meeting with philosophers and economists whose ideas challenged my own. I spoke with François Quesnay and the Physiocrats, who believed land was the source of all wealth. I admired their logic, but I disagreed. I had seen too much industry in Scotland and England to believe that land alone could account for prosperity. Still, it was in these travels that I sharpened my insight into commerce, taxation, and the workings of national economies. I returned home determined to write a book that explained not just what wealth was, but how it moved through a nation like blood through a body.

Writing The Wealth of Nations

In 1776, after years of contemplation and revision, I published An Inquiry into the Nature and Causes of the Wealth of Nations. In its pages, I laid out the principles that had shaped my life’s thinking: the power of specialization, the efficiency of markets, the dangers of monopolies, the benefits of free trade, and the phenomenon I described as the “invisible hand,” the unseen force that guides individuals pursuing their own interests to support the prosperity of the nation. I argued that a country's wealth lay not in its stored treasure but in its productive capacity and the freedom of its people to labor, innovate, and trade.

The Work Behind the Ideas

I observed firsthand how nations constrained their own growth through restrictive trade laws, burdensome monopolies, and excessive government control. I argued that competition, when fair and unimpeded, brought better goods, lower prices, and stronger economies. Yet I also warned that the state had responsibilities: to maintain justice, defend the nation, and provide public works that individuals could not build alone. What some later called pure capitalism was never my intention. I sought balance—freedom where it fostered prosperity, structure where it protected fairness.

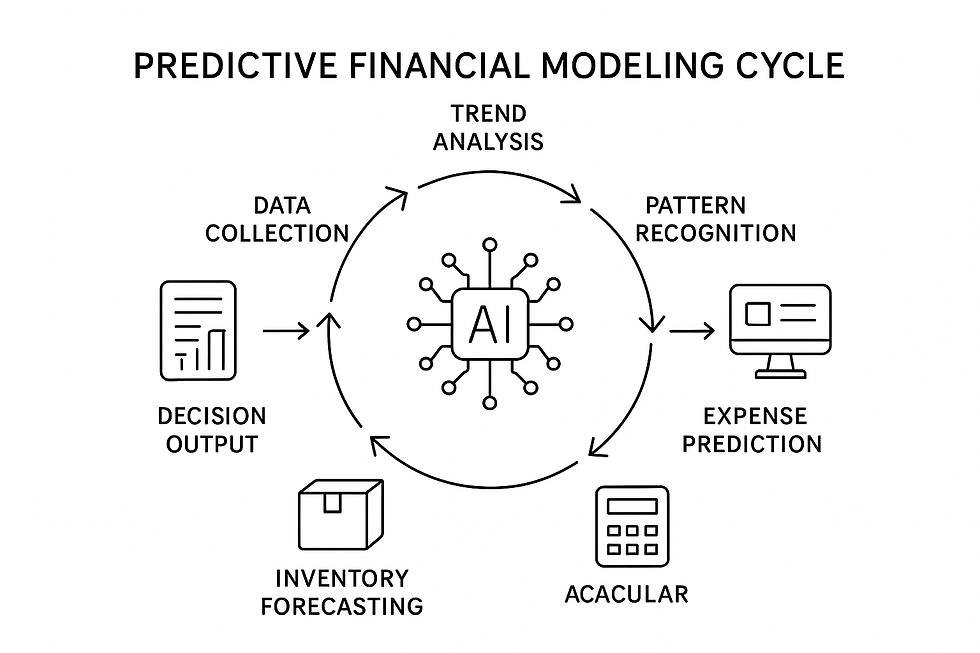

Cash-Flow Forecasting & Predictive Financial Modeling – Told by Adam Smith

In every age, the lifeblood of enterprise has been the movement of money. In my own time, merchants and manufacturers often relied on instinct or past experience to judge whether their ventures would prosper. Yet you now live in a world where the flow of revenue and expense can be observed, measured, and projected with extraordinary accuracy. Artificial intelligence has become the new interpreter of economic motion, turning raw information into foresight. What was once guesswork can now be shaped into reliable expectation.

Seeing Beyond the Present Moment

When I reflected on markets, I often observed that individuals act with limited knowledge, guided by their immediate circumstances. Today, however, your tools gather immense quantities of information—sales patterns, seasonal trends, customer behavior, and price movements—and assemble them into pictures of what is likely to come. Through instruments such as ChatGPT Advanced Data Analysis, Power BI Copilot, and Tableau AI, a business can peer beyond the present into the probable future. This is not prophecy; it is disciplined reasoning enhanced by machines capable of processing more data than any mind could manage alone.

Revenue as a Predictable Stream

In my time, revenue often rose and fell like the tide, and merchants could only prepare by saving prudently. Yet AI now studies purchasing habits, market cycles, and even subtle changes in consumer interest to forecast future income with remarkable precision. If a product’s popularity is growing, the system marks the trend; if demand wanes, it sounds a quiet warning. The entrepreneur does not need to hope blindly but may plan confidently, adjusting prices, expanding production, or entering new markets with informed judgment.

Expenses Unveiled Before They Arrive

Just as income may be forecasted, so too can expenses be anticipated in advance. AI follows patterns in payroll, supplies, logistics, and operational costs. It recognizes when expenditures are likely to increase—whether due to seasonal shifts, rising material prices, or inefficiencies hidden within the enterprise. These projections allow business owners to prepare before pressures arise. Instead of reacting to hardship, they may prevent it. Prudence, once grounded in caution, is now supported by analysis.

The Science of Inventory and Supply

One of the greatest challenges in any commercial system is determining how much to produce and when to produce it. Too much inventory consumes resources unnecessarily; too little leaves customers wanting. Artificial intelligence examines past sales, market fluctuations, and external factors such as holidays or weather patterns to predict precisely what will be needed. It aligns supply with demand, reducing waste and preserving profit. What manufacturers once learned through long experience, AI now computes in moments.

Patterns of Growth and the Guidance of Data

When I wrote of the division of labor and its power to enrich nations, I emphasized that growth is never random. It follows patterns—of innovation, trade, and human behavior. Today, your predictive systems discover these patterns with exquisite sensitivity. They detect early signs of expansion in a market, notice when a rising competitor threatens profitability, or reveal opportunities hidden beneath the surface of everyday transactions. With these insights, businesses may pursue growth not through conjecture but through knowledge.

Human Judgment in Partnership with Machine Insight

Though AI offers extraordinary clarity, its predictions are not commands. They are tools. Decisions must still rest in the hands of those who understand their enterprise, who can weigh risk, ambition, and moral responsibility. A machine may indicate that expansion is likely profitable, but it cannot comprehend the character of a business or the values of its owner. True wisdom arises when human judgment interprets the patterns revealed by AI. This partnership—your reason guided by the machine’s precision—creates a level of foresight that merchants of my era could scarcely imagine.

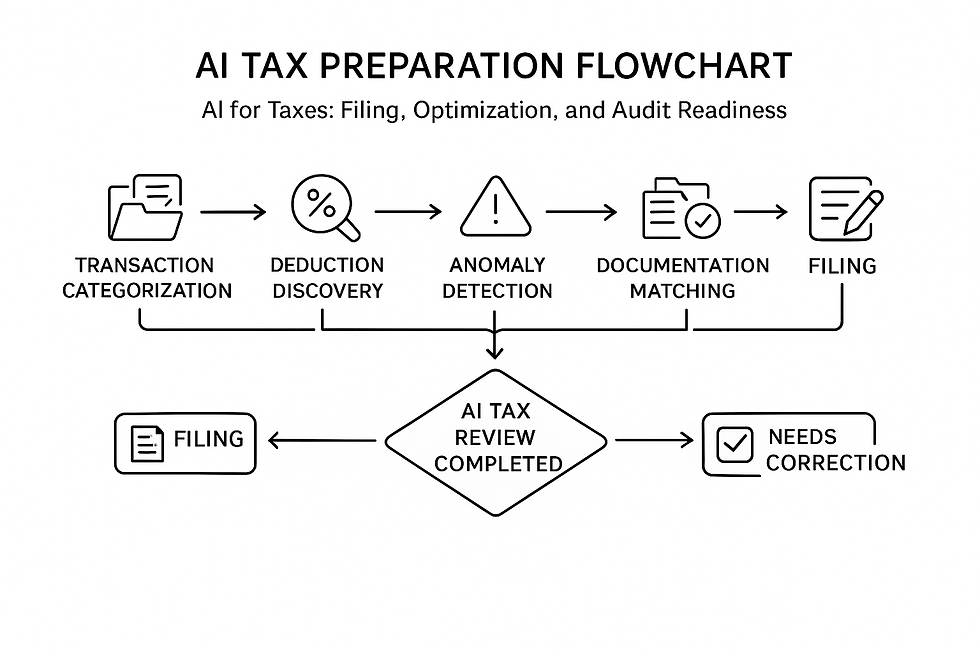

AI for Taxes: Filing, Optimization, and Audit Readiness – Told by Luca Pacioli

In every age, taxation has been both a duty and a challenge. Merchants in my time struggled to keep clear records of fees owed to city authorities, guild obligations, and trade tariffs. The calculations were often tedious, and any error invited scrutiny or penalty. In your era, taxation has grown far more complex, yet you possess instruments capable of managing its difficulty with remarkable precision. Artificial intelligence now serves as a guide through this maze, transforming burdensome tasks into orderly processes.

Organizing Taxes Through Intelligent Categorization

Where once a merchant’s chest overflowed with receipts awaiting careful placement into the proper accounts, your machines now categorize each expense automatically. When a transaction enters the system, AI identifies its nature—supplies, travel, wages, equipment—and assigns it to the correct tax category without hesitation. It evaluates patterns, vendor histories, and even descriptions on digital invoices. In my time, such organization required long hours and an attentive mind; now it is accomplished in moments, ensuring that the foundation of your tax records is sound and complete.

Deductions and the Wisdom of the Machine

The question of what may or may not be deducted has always troubled those responsible for their accounts. Today, artificial intelligence studies your transactions and compares them to thousands of similar cases, identifying opportunities for deductions that might otherwise be overlooked. It recognizes recurring expenses that qualify for relief, highlights potential credits, and even notes when a merchant has not taken advantage of benefits common in their line of work. This is not mere calculation—it is the careful application of rules to your unique circumstances.

Anomalies Revealed with Unfailing Vigilance

Where human clerks might fail to notice subtle inconsistencies, AI examines every entry with unblinking attention. It detects transactions that deviate from established patterns, expenses that appear misclassified, or charges that conflict with past behavior. These anomalies may indicate simple mistakes or fraudulent activity, but in either case, early detection prevents greater troubles. In my time, identifying such irregularities required years of experience. Now, algorithms perform the task with tireless diligence, protecting both accuracy and integrity.

Preparing for the Auditor’s Inquiry

An audit has never been a pleasant prospect, yet the readiness of one's records determines whether it becomes a trial or a formality. AI ensures that your books remain audit-ready at all times. Receipts are stored in accessible form, transactions are properly categorized, documents are matched to their entries, and discrepancies are flagged before an auditor ever arrives. It creates a trail of evidence supporting every figure. If a question arises, the system retrieves the justification instantly. This is the highest form of order: not merely keeping records, but keeping them in a state of perpetual readiness.

Filing with Confidence and Clarity

When the time comes to submit your tax return, artificial intelligence compiles the necessary information, performs calculations, checks for errors, and ensures that each figure aligns with the year’s records. It reduces the likelihood of misstatements, overlooked deductions, or accidental omissions. More importantly, it gives the merchant confidence. The filing becomes not a moment of anxiety but the final step in a process that has been maintained faithfully throughout the year.

The Partnership of Prudence and Automation

Though AI can perform remarkable feats, it does not replace the responsibility of understanding one’s affairs. Taxes remain a matter of stewardship. The machine provides clarity and accuracy, but the merchant must continue to act with diligence and honesty. Artificial intelligence strengthens the foundation, but you must determine how to build upon it. Together, your judgment and the machine’s precision create a system far more reliable than anything known in my age.

Contract Drafting & Legal Document Automation

When I first stepped into the world of legal automation, I expected a landscape full of complicated language and tedious drafting processes. What I found instead was a new era of clarity, where artificial intelligence could turn legal complexity into structured, understandable agreements. The machines don’t eliminate responsibility, but they streamline the process so thoroughly that what once took hours now takes minutes. In this new environment, contracts are no longer obstacles—they’re gateways to getting things done faster and more confidently.

Transforming Ideas Into Drafted Agreements

When an idea needs a contract around it—a partnership, a licensing deal, a service agreement—I turn to systems like DocuGPT. With a simple prompt describing the nature of the relationship, the scope of work, and the expectations of both sides, the AI drafts a full agreement with astonishing accuracy. It sets out definitions, outlines responsibilities, frames payment terms, and inserts the protections I might have forgotten to name. I am not relying on the machine alone, of course. I read through every line. But the starting point is no longer a blank page. It is a fully structured document waiting to be customized.

Interpreting Existing Contracts With Machine Precision

Sometimes the challenge isn’t creating a contract—it’s understanding one. Harvey.ai and Luminance have become tools I rely on to break dense legal language into clear explanations. With a quick upload, the AI examines the agreement clause by clause. It highlights unclear terms, flags unusual provisions, and points out places where liability might tilt too heavily toward one party. When the machine surfaces these insights, it becomes easier for me to ask the right questions, request revisions, or add protections I might have overlooked. The AI isn’t making the decisions; it’s helping me see what needs attention.

Reviewing Clauses With Tireless Consistency

Consistency is essential in legal documents. A single misplaced phrase can change the meaning of an entire agreement. Tools like Luminance and DocuGPT ensure that the language stays aligned throughout the document. They compare clauses, check defined terms, and ensure the obligations written on page three match those revisited on page thirteen. Where a human might lose focus after reviewing too many lines, the machine maintains its accuracy from beginning to end. It becomes the steady second set of eyes that every writer of legal agreements wishes they had.

Fighting Legal Friction With Automated Solutions

There are moments when contracts intersect with everyday problems—subscription disputes, refund requests, or legal rights that need quick action. That’s where services like DoNotPay come in. When someone is up against a company that isn’t responding or refuses a legitimate request, DoNotPay drafts letters, cites relevant statutes, and prepares filings that level the playing field. It takes the fear out of legal conflict and replaces it with structure and confidence. Whether it’s a demand letter or a cancellation notice, the AI shifts the situation from frustration to resolution.

Building Trust Through Transparent Automation

The automation of legal documents does not remove the human element—it enhances it. When an agreement is drafted quickly and reviewed thoroughly, all parties feel more secure. The clarity of the contract reflects the clarity of the relationship. I’ve found that using AI tools builds trust because the contracts are easier to understand, easier to amend, and harder to misinterpret. Transparency becomes a natural byproduct of the process.

The Human Voice Behind Every Decision

Despite the power of these tools, I remain the one making the final call. The AI can propose clauses, analyze terms, and flag risks, but only I can decide whether the deal aligns with my values, my goals, and my long-term vision. Automation simplifies the work, but it does not replace the judgment required to form good partnerships. In the end, the purpose of these tools is to free the human mind to focus on strategy, relationships, and meaningful decisions—while the machine handles the structure behind them.

Regulatory Compliance & Risk Monitoring

When I began exploring how artificial intelligence supports regulatory compliance, I discovered a world where oversight no longer depends solely on human vigilance. Instead, it is reinforced by systems that watch every financial movement with a precision that no team of analysts could match. Compliance is no longer something you scramble to maintain at the end of the month; it becomes a living process, active every moment. The complexities of regulations—once intimidating—start to feel manageable when AI stands beside you as a guardian and guide.

Navigating AML in a Data-Driven Age

Anti-money laundering rules used to be a tangled web of reports, thresholds, and manual reviews. Today, AI cuts through the complexity by learning what typical behavior looks like for each customer. When a transaction deviates from those patterns, the system recognizes the anomaly instantly. It might flag a sudden large transfer, a series of unusual withdrawals, or a pattern that resembles known laundering techniques. Instead of reacting after damage is done, the AI warns you as the risk emerges. In my own work, this changes the entire mindset: compliance shifts from defensive to proactive.

The Precision of KYC Automation

Know-Your-Customer processes can be painfully slow when done manually—collecting documents, verifying identities, and checking for inconsistencies. AI automates these steps with remarkable accuracy. It scans identification, cross-references databases, and confirms whether the information matches legitimate sources. It can even detect subtle signs of forged documents or mismatched details. The onboarding process becomes faster, smoother, and far more reliable. What once felt like a chore now becomes a streamlined entry point into safe and trusted business relationships.

Fraud Detection at Machine Speed

Fraud rarely announces itself. It hides in small inconsistencies, irregular timing, or patterns that are easy to miss. AI is built to notice these faint signals. With each transaction, it measures whether the behavior aligns with past activity. It identifies access attempts from unusual locations, sudden spikes in account usage, or purchases that fall outside expected norms. When I see these alerts in action, it feels like watching a security team that never sleeps, never blinks, and never overlooks a detail. Fraud may still attempt to slip through, but AI dramatically narrows the space in which it can hide.

Compliance Dashboards as Living Maps

The dashboards powered by these systems pull all the data together into an organized and constantly updated view. I often describe them as maps of the organization’s financial health. They show risks rising or falling, highlight unresolved issues, track AML and KYC tasks, and reflect the overall state of compliance. Instead of reading through pages of reports, I can glance at a single screen and understand the landscape. It brings a visual clarity that almost feels like looking at a heartbeat monitor for the entire business.

Audit Trails That Tell the Whole Story

Audit readiness used to involve scrambling to find old documents, reconstructing decisions, and gathering explanations long after the moment had passed. AI changes that completely. Every action is recorded automatically—every approval, every modification, every flagged risk. The audit trail becomes a precise record of how the company operated hour by hour. When an auditor asks a question, the evidence appears instantly. Nothing is misplaced. Nothing is guessed. It's accountability made effortless.

The Human Responsibility Behind the System

Even with all this technology, I’ve learned that compliance still demands human judgment. AI can warn, guide, and analyze, but it cannot decide what kind of organization you choose to be. The system will show you the risks, but you must choose to address them. It will spotlight suspicious activity, but you must decide whether it aligns with your values and obligations. Technology strengthens compliance, but integrity sustains it.

Financial Fraud Detection & Anomaly Scanning

When I first explored how AI uncovers financial fraud, I was struck by one central truth: fraud rarely looks dramatic. It hides in small, quiet movements—tiny inconsistencies, misplaced timing, or subtle deviations that human eyes often miss. Yet machine-learning systems see these shifts instantly. They read financial patterns the way a seasoned detective reads clues. What once felt like searching for a needle in a haystack now becomes a matter of teaching a system what a needle looks like.

Teaching the System What “Normal” Means

Every business has its own natural rhythm. Purchases tend to follow patterns, payments have predictable timing, and customers develop habits in how and when they transact. AI begins by learning these patterns. It observes the ebb and flow of activity until it builds a profile of what “normal” looks like. Once that baseline is established, the machine watches for anything that falls outside of it. A sudden late-night transaction, an unexpected location, or an unusual amount triggers an alert. The goal is not to accuse but to notice—to catch the abnormal before it becomes harmful.

Real-Time Detection of Unusual Transactions

What makes modern fraud detection so powerful is its speed. The moment a suspicious transaction occurs, the system evaluates it. Was it larger than typical purchases? Did it break the customer’s pattern? Was the payment origin unfamiliar? When the AI detects unusual behavior, it doesn’t wait for a report the following morning. It pauses the transaction, alerts the business, and offers recommendations on how to proceed. This immediate intervention often prevents losses before they ever reach the ledger.

Guarding Against Identity Theft

Identity theft has become one of the most damaging threats in digital commerce. AI counters this by monitoring not just financial activity but the behavior surrounding it. If someone logs in from a new device, attempts a password reset at an odd hour, or tries to access parts of the system they’ve never touched before, the machine recognizes the discrepancy. Even subtle changes—like typing speed or navigation patterns—can signal unauthorized access. It’s a level of vigilance no human guard could maintain.

Fighting Chargeback Fraud with Behavioral Insight

Chargeback fraud often appears legitimate on the surface: a customer claims a product didn’t arrive, a purchase wasn’t authorized, or a subscription was mistakenly billed. AI compares that claim to the customer’s history, shipment records, usage logs, and even common fraud patterns. It can flag cases that follow known fraud signatures while validating those that truly deserve a refund. This distinction protects businesses without punishing honest customers. It brings fairness to a process that has long been easy to exploit.

Payment Anomalies and the Machine’s Intuition

Not all fraud is deliberate. Sometimes errors and system glitches create anomalies that could cause financial chaos if left unchecked. AI monitors payment gateways, timing intervals, routing details, and transaction volumes. It notices when duplicate payments occur, when a batch runs at an unusual time, or when a system behaves inconsistently. The machine’s ability to connect these dots keeps small errors from becoming large problems, preserving both accuracy and trust.

A Partnership Between Oversight and Action

As powerful as these systems are, they don’t replace the need for human decision-making. When AI flags something unusual, it hands the choice back to a real person: investigate, approve, or stop the transaction. I’ve found this partnership to be the core strength of AI-driven fraud detection. The machine handles the constant watching and comparing, while the human brings judgment, context, and values into the final decision. Together, they create a system capable of protecting an organization in ways we once thought impossible.

AI-Assisted Payroll, Invoicing, and Accounts Payable/Receivable

When I first saw how AI manages the everyday financial rhythm of a business, I realized that the most transformative changes aren’t always dramatic. Sometimes the biggest impact comes from the tasks we repeat constantly—payroll cycles, invoicing routines, payment reminders, and vendor transactions. These steady, unending responsibilities are where AI shines brightest. By taking over the mechanics, it frees businesses to focus on strategy rather than paperwork.

Automating Payroll With Precision and Predictability

Payroll once meant hours of manual checks—calculating hours, adjusting for overtime, tracking benefits, verifying tax withholdings, and ensuring every employee received the correct amount. AI removes the friction from this entire process. It pulls timesheets automatically, adjusts for holidays or unique schedules, and applies tax rules with unwavering accuracy. When payday arrives, the system runs through its calculations and prepares payments without hesitation. What used to take a day or more now settles into a predictable, error-free routine.

Creating and Sending Invoices Without Delay

Invoicing used to be the task I postponed because it felt so repetitive: gather the details, enter amounts, format the document, then send it. Now, AI handles it instantly. When a service is completed or a product is delivered, the system drafts an invoice on the spot. It fills in the client name, the line items, the payment terms, and even the branding. It sends the invoice automatically at the right time—no forgotten bills, no delayed revenue, no scrambling at the end of the month. It transforms the billing process from a chore into a smooth, continuous flow.

Managing Vendor Payments With Clear Records

Vendors rely on timely payments, and businesses rely on vendors. AI ensures neither side experiences unnecessary stress. When a bill arrives—whether through email, a scanned document, or an online portal—the system reads it, extracts the key details, and prepares it for approval. Once approved, the payment is sent automatically on the correct date. It keeps perfect track of what has been paid, what is pending, and what needs verification. This consistency strengthens relationships and prevents the small oversights that can snowball into larger conflicts.

Following Up on Payments With Unmatched Consistency

No one enjoys chasing down late payments, but every business faces that moment eventually. AI removes the discomfort by sending polite, timely reminders based on the client’s payment terms. It can escalate its tone gradually—from a gentle nudge to a formal notice—while keeping the message professional and consistent. It never forgets a due date and never delays a follow-up. That reliability often results in quicker payments and fewer awkward conversations.

Analyzing Collection Risk Before Trouble Appears

What surprised me most was AI’s ability to predict which clients might struggle to pay their invoices. By analyzing payment histories, transaction patterns, and even communications, the system identifies risks early. It can warn you when a client’s behavior begins to shift, giving you time to adjust terms, request partial payments, or hold off on new work until the account is settled. This foresight protects cash flow and prevents loss before it occurs.

Creating a Financial Rhythm That Supports Growth

When payroll runs smoothly, invoices go out automatically, and vendor payments stay organized, something important happens: the business finally gains room to grow. You aren’t distracted by the routine tasks that used to pile up. You’re free to negotiate better contracts, expand services, or launch new products. AI doesn’t take away responsibility—it strengthens the financial foundation so decision-making becomes clearer and more confident.

Legal Research & Case Analysis with AI Agents – Told by Zack Edwards

When I first stepped into AI-assisted legal research, I expected it to feel like navigating a digital law library. Instead, I found myself working with tools that behaved more like seasoned legal assistants—always ready, always organized, and always capable of connecting ideas that might take a human hours to uncover. With AI agents guiding the process, legal research transforms from a slow excavation into a fast, focused conversation.

Turning Complex Laws into Clear Explanations

Whenever I need to understand a statute, regulation, or recent ruling, I turn to legal personas powered by ChatGPT. These personas read the law with perfect consistency, breaking dense language into clear summaries. I can ask for the heart of the rule, the exceptions, or the historical reasoning behind it, and the agent responds as though it has spent years studying that area. Instead of wading through pages of text, I get a distilled version that helps me immediately understand my obligations and options.

Reviewing Court Cases Without Getting Lost in Details

Reading through a court opinion can feel overwhelming—layers of reasoning, references to past decisions, and legal terminology that builds on decades of precedent. Tools like Harvey.ai make this process manageable. I upload the case, and the system extracts the key facts, legal issues, holdings, and reasoning. It presents the core ideas in a format that feels both accurate and accessible. When I need to compare several cases, the AI highlights the differences and connections, giving me a clearer view of the legal landscape.

Creating Accurate Citations in Moments

Legal citations require precision. Every abbreviation, date, and reference must be correct. AI tools reduce the stress of this process entirely. Once the system understands what case or statute I am referencing, it generates perfectly formatted citations—whether for a memo, a report, or internal documentation. What used to take careful checking now happens instantly, freeing me to focus on the substance of the argument rather than the formatting of the footnotes.

Drafting Legal Memos With Machine-Assisted Structure

One of the most powerful aspects of AI legal tools is their ability to create first drafts of memos. If I provide the facts of a situation and the legal question involved, systems like Casetext CoCounsel generate a structured memo that includes issue statements, relevant legal standards, analysis, and preliminary conclusions. I still review and refine the content, but the framework is already set. It feels like having a skilled junior associate prepare the outline while I bring the nuance and judgment.

Cross-Checking Information With Tireless Accuracy

Human researchers sometimes overlook contradictions or inconsistencies, especially under tight deadlines. AI agents don’t. As I work through a legal problem, the tools constantly compare my drafts against the sources they’ve analyzed. If a fact is misstated or a precedent is misapplied, the system alerts me. It ensures that the reasoning remains aligned with the actual law, safeguarding accuracy at every stage.

Building Confidence Through Clarity and Speed

The combination of rapid research, structured explanations, and reliable cross-checking creates a level of confidence I didn’t experience before adopting these tools. Legal analysis no longer feels like navigating a maze in the dark. AI lights the path—showing where the law is clear, where precedent supports a position, and where additional investigation is needed. Instead of drowning in information, I can move decisively through it.

Human Judgment at the Center of Every Decision

For all the assistance AI provides, the final understanding and decision-making still rest with me. The tools can summarize, compare, and draft, but they cannot weigh ethical considerations or the strategic nuances of a situation. They act as amplifiers of human judgment, not replacements for it. When I use them well, I bring together the precision of a machine and the insight of experience.

AI for Business Insurance & Liability Analysis – Told by Zack Edwards

When I first started exploring AI in the world of business insurance and liability, I expected the tools to simply help organize documents. What I found instead was a system capable of reading, interpreting, and evaluating risk with a level of clarity that I had never seen before. Insurance used to feel like a fog—dense policies, vague terms, and long lists of exclusions. AI cuts through that fog, revealing the structure behind every clause and helping businesses understand exactly where they stand.

Drafting Risk Assessments with Machine-Level Objectivity

Whenever I need a risk assessment for a project or a partnership, I lean on AI to help identify potential vulnerabilities. I provide details about the business, its assets, and its operations, and the system constructs a thorough evaluation. It identifies areas where liability might arise, highlights gaps in coverage, and even compares the business’s risk profile to similar organizations. Instead of guessing or hoping I haven’t overlooked something, I can see the landscape clearly—mapped out with objectivity and precision.

Evaluating Liability Before It Becomes a Problem

Liability issues often stay hidden until they cause damage. AI analyzes contracts, operating procedures, insurance documents, and historical cases to spot where responsibilities may not be clearly defined. It notices when a clause exposes the business to unnecessary risk or when a policy won’t cover a crucial activity. This early detection allows for corrections before they turn into disputes. It’s like having a legal and insurance advisor who never tires and never misses the fine print.

Summarizing Insurance Policies with Clear, Human-Friendly Language

Insurance policies have always been notoriously dense. Paragraph after paragraph of technical language hides the actual meaning. AI changes that completely. When I upload a policy, the system breaks it down into its key components: what’s covered, what’s excluded, what requires notice, and what has limits. It highlights the important sections and explains their implications in straightforward terms. Suddenly, the policy feels readable. Decisions that were once confusing become far easier to make.

Supporting Claims Documentation with Organized Evidence

Filing an insurance claim often becomes a chaotic scramble—finding receipts, reconstructing timelines, and assembling proof. AI organizes this process from the beginning. Whenever a document enters the system, it’s tagged, categorized, and stored in a way that becomes instantly accessible later. When a claim arises, AI gathers the relevant records automatically: invoices, communications, contracts, photos, and damage reports. It helps prepare the narrative, ensuring the evidence aligns with the requirements of the policy. Instead of reacting with stress, I respond with structure.

Comparing Policies to Find the Best Fit

One of the most impressive capabilities is the way AI compares multiple insurance policies side by side. It can highlight differences in coverage, deductibles, responsibilities, and exclusions. It shows which policy offers stronger protection in high-risk areas and which one leaves dangerous gaps. What once required hours of reading can now be done with a glance. The decision becomes a matter of strategy instead of guesswork.

Empowering Businesses Through Clarity and Preparation

The real power of AI in insurance and liability isn’t just efficiency. It’s clarity. When a business clearly understands its coverage, its risks, and its obligations, it can operate with far greater confidence. There’s no lingering uncertainty about what might happen or how a claim might unfold. The organization becomes better prepared and better protected.

Human Judgment at the Heart of Every Choice

Still, the final responsibility always rests with me. AI can show me the risks, summarize the policies, and prepare the documents, but I’m the one who must decide what level of protection is appropriate. It’s my values, priorities, and goals that determine the final course of action. The technology strengthens my perspective—it never replaces it.

AI-Driven Internal Controls & Corporate Governance

When I first explored how AI supports internal controls and corporate governance, I realized that the greatest risks often come from inside an organization, not outside it. Mismanaged permissions, unclear responsibilities, and gaps in oversight can create vulnerabilities that no policy manual can fully eliminate. But AI changes this dynamic entirely. It brings a level of transparency and constant awareness that helps protect a business from internal misuse long before it becomes a threat.

Keeping Segregation of Duties Clean and Consistent

Segregation of duties has always been one of the most important safeguards in any organization. No single person should control every step of a financial or operational process. AI systems monitor these arrangements continuously. If one individual suddenly gains access to multiple critical functions—approving invoices, issuing payments, and adjusting accounts—the system notices immediately. It flags unusual access combinations and suggests corrective actions. This turns what was once a periodic review into an ongoing shield.

Managing Permissions with Precision

In traditional systems, permissions often expand gradually until someone has far more authority than their role requires. AI monitors how permissions evolve over time, comparing them to established roles. When a permission looks out of place or unnecessarily powerful, the system raises a warning. It becomes much harder for privilege creep to slip by unnoticed. In my own work, this has brought incredible peace of mind—knowing that the digital structure of the organization matches its actual hierarchy and responsibilities.

Access Logs That Tell a Complete Story

Access logs used to be nothing more than technical trails buried deep within a system—useful, but rarely examined. AI transforms these logs into living indicators of behavior. It tracks patterns: who logged in, when, from where, and what they accessed. When someone opens records at unusual hours or repeatedly attempts to view restricted files, AI recognizes these signs instantly. It helps organizations intervene early, not after damage is done. The logs stop being historical records and become active tools for protection.

Role-Based Compliance That Adjusts to Real Behavior

Organizations change constantly—new roles, new responsibilities, new teams. AI adapts to these changes. Instead of enforcing static rules, it analyzes how people actually work. If a role begins handling responsibilities outside its established scope, the system identifies the shift and evaluates whether it introduces risk. It ensures that compliance rules grow with the company rather than becoming outdated. This dynamic approach keeps governance aligned with reality instead of an old handbook.

Digital Trails That Strengthen Accountability

Every action—approvals, edits, submissions, access attempts—creates a digital footprint. AI organizes these trails into coherent stories, linking actions to individuals and decisions to outcomes. When a problem arises, the system can reconstruct the sequence instantly, making accountability clear and fair. This isn’t about blaming people; it’s about understanding what happened and preventing repeat issues. The clarity makes governance stronger and far more transparent.

Stopping Internal Abuse Before It Starts

What surprised me most was how these systems reveal early signs of internal misuse. AI detects unusual attempts to alter data, suspicious changes to permissions, or access that conflicts with known responsibilities. It identifies subtle indicators of fraud or policy violations long before a human might notice them. This proactive approach turns governance from an after-the-fact process into a preventive strategy.

AI as a Partner in Ethical Leadership

The purpose of internal controls isn’t to create fear—it’s to build trust. When everyone knows the systems are fair, consistent, and constantly monitored, the organization becomes safer for both leaders and employees. AI doesn’t replace ethical leadership, but it strengthens it by ensuring that the structure supports integrity. In the end, the decisions remain human, but the awareness becomes sharper and the pathways clearer.

Vocabular to Learn While Learning About AI in Finance, Accounting, and Legal

1. Audit Trail

Definition: A recorded history of every action or change made in a system, used for verification or investigation.Sentence: The AI system kept an audit trail showing who approved each payment and when.

2. Compliance

Definition: Following laws, rules, or standards required by governments or organizations.Sentence: AI tools help companies maintain compliance by checking every transaction for potential violations.

3. Predictive Modeling

Definition: Using data and mathematics to forecast future events or trends.Sentence: Predictive modeling helped the company estimate next month’s cash flow.

4. Machine Learning

Definition: A type of AI that learns from data and improves its performance over time without being explicitly programmed.Sentence: Machine-learning tools learned the company’s spending patterns to spot unusual behavior.

5. Liability

Definition: A legal responsibility for something, especially related to risk or financial loss.Sentence: Understanding liability helps businesses prepare for potential problems before they happen.

6. Ledger

Definition: A record of financial transactions organized into accounts.Sentence: AI accounting software updates the ledger automatically whenever money is spent or earned.

7. Segregation of Duties

Definition: A control practice where different tasks are assigned to different people to prevent fraud or errors.Sentence: AI monitors segregation of duties by ensuring no employee has too much control over the financial process.

8. Fraud Detection

Definition: The process of identifying dishonest or illegal activities, especially involving money.Sentence: Fraud detection systems use AI to catch suspicious charges the moment they occur.

8. Anomaly

Definition: Something that is unusual or different from normal patterns.Sentence: The AI spotted an anomaly in the payroll data, suggesting a mistake or possible misuse.

9. Deduction

Definition: An expense that can be subtracted from taxable income to reduce taxes owed.Sentence: The AI identified several business deductions the owner had forgotten to claim.

10. Identity Verification

Definition: The process of confirming that someone is who they claim to be, usually through documents or digital checks.Sentence: AI speeds up identity verification by scanning IDs and matching them to official records.

Activities to Demonstrate While Learning About AI in Finance and Legal

Build a Smart Budget with AI – Recommended: Intermediate to Advanced Students

Activity Description: Students create a simple personal or classroom budget, then use an AI tool to categorize expenses, detect patterns, and make predictions about future spending.

Objective: To introduce students to basic bookkeeping, categorization, and how AI helps analyze financial data.

Materials:• Paper or Google Sheets• Sample expense list• ChatGPT (Advanced Data Analysis mode recommended)

Instructions:

Provide students with a list of fictional monthly expenses (school supplies, snacks, field trips, etc.).

Ask them to sort the expenses into categories manually.

Have them upload or type the same list into ChatGPT and ask it to categorize the expenses automatically.

Ask ChatGPT: “Can you analyze this monthly budget and predict next month’s expenses?”

Students compare their manual work with the AI-generated analysis.

Learning Outcome: Students see how AI accelerates financial organization and forecasting while understanding the core concepts of budgeting and expense categories.

AI Fraud Detective Challenge – Recommended: Intermediate to Advanced Students

Activity Description: Students examine a list of transactions and use an AI tool to identify suspicious charges or behavior patterns, mimicking real-world fraud detection systems.

Objective: To help students understand anomalies, fraud prevention, and how machine-learning models detect unusual activity.

Materials:• A set of fictional bank statements• Highlighters• ChatGPT or another AI anomaly-detection simulation prompt

Instructions:

Hand students a bank statement with 20–30 transactions—most normal, some suspicious.

Students highlight transactions they believe are unusual.

Enter the same list into ChatGPT and ask:

“Identify any anomalies or transactions that look suspicious and explain why.”

Compare student findings with AI findings.

Discuss which clues suggest fraud (odd times, unusual locations, new merchants, large spikes).

Learning Outcome: Students learn how AI systems protect financial accounts and why anomaly detection matters in accounting and finance.

AI-Powered Business Simulation – Recommended: Intermediate to Advanced Students

Activity Description: Students run a fictional business for a “mini-quarter,” making decisions about payroll, invoicing, and expenses with the help of AI tools.

Objective: To demonstrate how AI assists in business operations, financial planning, and corporate compliance.

Materials:• Scenario cards (sales, expenses, vendor bills)• Google Sheets• ChatGPT or Excel Copilot• Printed “business dashboard” template

Instructions:

Divide students into small business teams (e.g., a smoothie shop, tutoring service, craft store).

Pass out scenario cards that represent weekly financial events.

Students enter the transactions into a spreadsheet.

Ask ChatGPT or Excel Copilot to:

• categorize transactions

• generate invoices

• calculate payroll

• forecast next week’s revenue

At the end of the simulation, teams present their “quarterly report.”

Learning Outcome: Students experience firsthand how AI supports financial management, internal controls, and decision-making.

KYC (Know-Your-Customer) Identity Check – Recommended: Intermediate to Advanced Students

Activity Description: Students perform a mock KYC compliance check by reviewing fictional customer profiles, spotting inconsistencies, and using AI to verify identity elements.

Objective: To teach students how banks verify identity, prevent fraud, and follow compliance laws.

Materials:• Fictional customer identity cards (names, addresses, IDs, transactions)• Red and green stickers• ChatGPT (text-only)

Instructions:

Give students several fictional identity profiles—some accurate, some with errors.

Students mark information they think looks suspicious using stickers.

Ask ChatGPT:

“Compare these identity details and list any mismatches or possible red flags.”

Students discuss why banks must verify identities and what happens when details don’t line up.

Learning Outcome: Students understand the importance of identity verification in preventing fraud and staying compliant with regulations.

Comments